In the iconic 1982 sci-fi film, "Blade Runner," the world is populated by flying cars and robots so advanced, they're indistinguishable from real humans.

This futuristic vision wasn't set 100, or even 1,000 years in the future. It was set in 2019.

While 2023 doesn't have the flying cars or humanoid robots "Blade Runner" predicted we'd have by 2019, today's businesses have many sophisticated tools at their disposal. With financial process automation, modern businesses can accomplish tasks that were unimaginable in 1982 (or even in 2002).

With the power of financial process automation, financial planning and analysis platforms can skyrocket your productivity, boost your accuracy and unlock new functionality in 2023 and beyond.

Financial Automation is revolutionizing the way businesses approach productivity and business intelligence. To make the most of automation in 2023 and beyond, you need to understand the goals of financial process automation. These goals include:

There are many things that humans do far better than computers--socialization, balancing upright and language processing. Where automation truly shines is in accomplishing repetitive tasks such as sending emails, duplicating contract workflows and sorting invoices.

While today's automation tools are nowhere near replacing human labor or intelligence, they are useful assistants for automating monotonous, tedious tasks so skilled humans can spend their time doing what they do best--making creative decisions, networking and establishing a long-term vision.

Source: Automizy

While automation is far from perfect, financial process automation can boost your accuracy while improving efficiency in the process.

One common application of financial process automation is budgeting. This tends to be not only time consuming but also error prone, as human workers can easily transpose a number, add or delete columns or overlook a line item.

With financial process automation, however, you can easily create budgets based on any requirements. Not only can an automation platform create a budget faster, it can also do so with a greater degree of accuracy than even the most skilled and diligent worker.

Financial process automation isn't just a shortcut to quick, accurate results. It also fuels business intelligence and analytics to find insights that would be impossible without automation tools. For example, financial process automation can perform business-wide analytics, rolling forecasts and variance reports in next to no time.

Automation excels at finding hidden trends that would be invisible to even the most trained human eye. Smart businesses are using financial planning automation to unlock new insights that would be impossible without today's modern tools.

Read Vena's Complete Guide to FP&A Automation.

The only constant in business is change. Automation has already revolutionized the business world, but you can expect to see financial process automation grow even more sophisticated and functional in 2023 and beyond.

The most important trends in automation for 2023 are end-to-end automation, platform integration and easier reporting and visualization.

Historically, many financial process automation tools have existed in their own bubbles. While these tools have helped businesses with components of their financial processes, they have complications.

When automation can only accomplish part of a task, you might spend more time wrestling with incompatible tools than you save by automating a process. Automation should make your life easier--not harder.

To combat this difficulty, end-to-end automation has been on the rise, and you should expect to see that trend continue into 2023. Rather than just tackling a single component of a financial process, end-to-end automation either accomplishes a wider range of tasks than their predecessors or automates their workflows themselves so you can spend less time babysitting your automation tools and more time working on important tasks.

If you've ever bought a piece of technology, you likely know the struggle of each brand having its own suite of proprietary apps for everything from messaging to listening to music to browsing the web. For users who are already experienced and comfortable with their app of choice, these new platforms are inconvenient and unnecessary.

Similarly, the future of financial process automation tools in 2023 is platform integration. Rather than using proprietary interfaces, expect to see more tools integrated into the apps you already use, such as Microsoft Word and Excel.

In fact, Excel has one of the world's highest penetration rates with 99.99% of businesses around the world using Excel. While legacy automation tools are struggling to reinvent the wheel, financial process automation in 2023 should integrate with the platforms you already use.

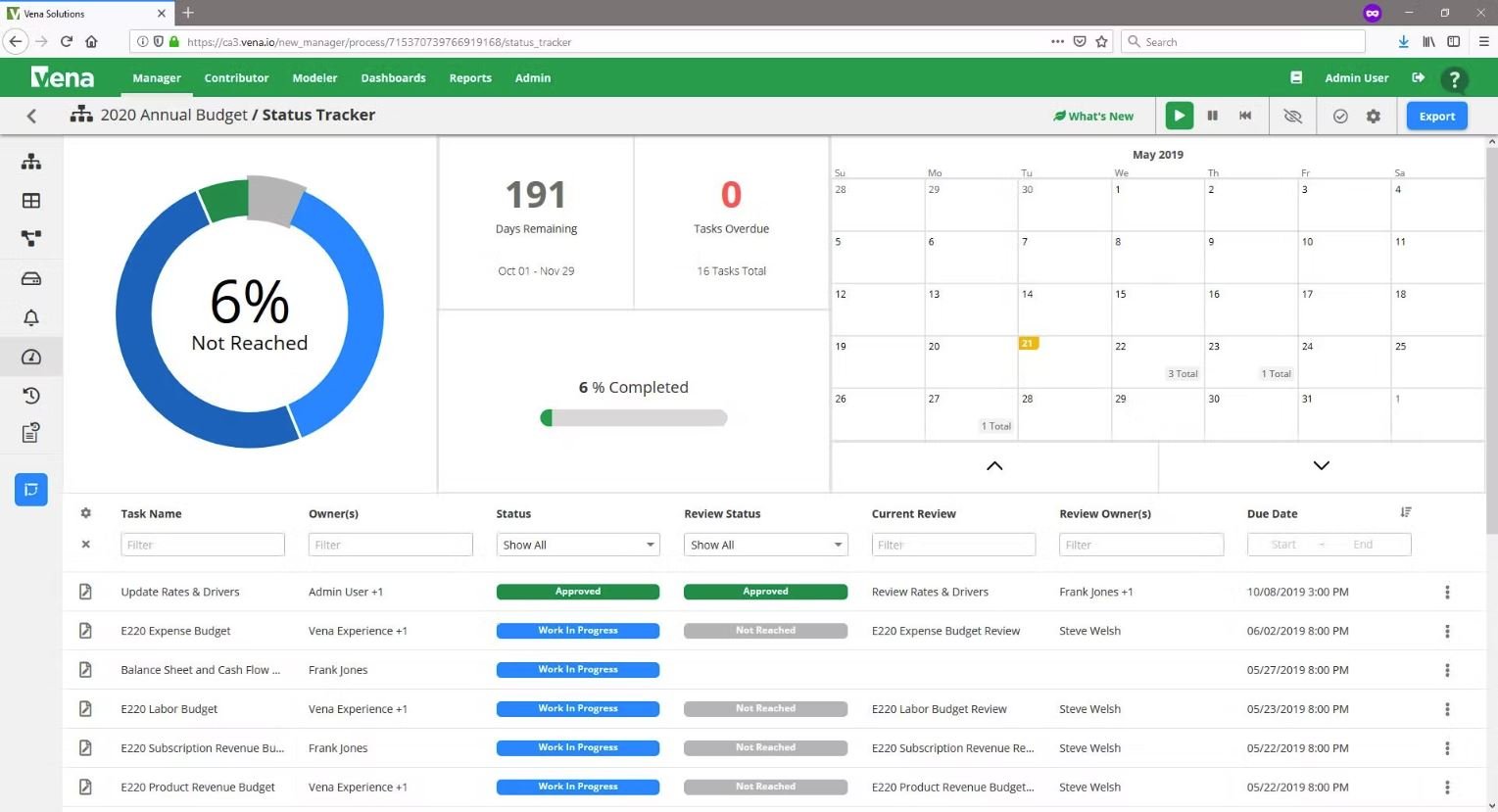

Source: Vena

Using an automation tool can sometimes feel like flying a plane--it might technically make the journey faster. But if you don't know what all the buttons do, you'll have a hard time getting off the ground at all.

What if automation could feel less like defusing a bomb, and more like riding a bike? While older automation tools are overcomplicated and rely on niche expertise to operate, financial process automation in 2023 will emphasize easy reporting and visualization. In legacy platforms, analyzing data was just the beginning of the journey--turning it into readable reports was yet another hurdle for business intelligence users. In 2023 and into the future, analysis and reporting will be powered by AI and automation to make insights and visualizations available at the click of a button.

Read 4 Financial Workflows You Haven't Thought To Automate.

We may still be a few years away from flying cars and seeing lifelike robots, but in many ways, the future is already here.

Automation tools are revolutionizing the way companies approach financial planning and analysis--and with the help of Vena's financial process automation tools, you can increase efficiency, improve accuracy and unlock functionality like never before.

Olivia MacDonald is a Senior Manager of FP&A at Vena. A creative problem solver who enjoys analyzing and detangling complex situations to make things better, she’s experienced in leading multiple projects at once and has found the key to success to be documentation, communication and teamwork. Olivia is passionate about removing manual, clunky and repetitive tasks from finance professionals’ working days so they can focus on what they believe truly adds value to the business instead. At work, she’s also heavily involved with Vena’s Women+ employee resource group, which collaborates with thought leaders and companies across the globe to remove intersectional barriers in the workplace. Outside of work, Olivia also takes part in youth engagement and education programs as a volunteer.