Across the business world, CFOs and other finance leaders are looking for ways to meet the growing demands being placed upon their teams. Management and stakeholders are demanding more trusted, up to date numbers and accurate forecasting. Externally, auditors and regulators are demanding more detailed information spanning virtually every aspect of the business.

To meet these ever growing demands, finance teams need to be more efficient than ever. Productivity is no longer just about saving time and money, but a fundamental indicator of a finance team's ability to hold up their side of the business. Indeed, inefficiencies in Finance can have costly consequences to the company's financial health, reputation and even shareholder value.

There's just one problem - inefficiencies are rampant in finance departments at companies of all shapes and sizes. And the magnitude of these inefficiencies - in wasted time, redundant work and more - is shocking.

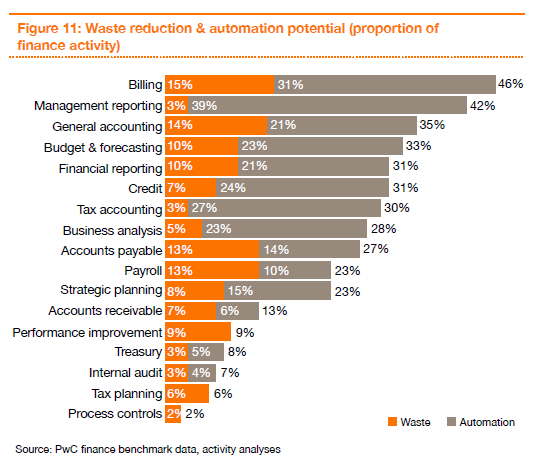

Consider PwC's recent findings on how finance teams are spending their time, and wasting it. Depending on the function (see figure) as much as 46% of the time spent in finance is either wasted effort, or work that can easily be automated.

Another study cited in CFO.com underscored this finding, with 80 percent of mid-sized to large companies getting less than 50 percent of the productivity they want out of their budgeting and forecasting teams. This comes from a global survey of CFOs undertaken in the first half of 2015 by CEB, a member-based advisory.

CEB found that timeliness was the biggest challenge inherent in the financial forecasting process, cited by 45 percent of financial leaders. Other common issues included depth of forecasting (33 percent), accuracy (26 percent), transparency, insight, clarity and efficiency.

Based on these findings, CEB determined that the majority of companies today have significant room for improvement in the field of financial planning and analysis (FP&A).

"The best FP&A teams treat the root causes of variance by distinguishing controllable from uncontrollable performance drivers and doubling down on accuracy in the underlying assumptions," the CEB report stated.

In business, there are many factors influencing your success that you can't control, including the economic climate, your customers' disposable income and the actions of your competitors. But when it comes to the factors you can control, such as your company's productivity and efficiency, it may be time to ask yourself a few fundamental questions: