“I love how quickly we can iterate now and model any unique revenue scenario we can think of … Vena really resonated with me as a finance professional right from the start—because any modeling I can do in Excel, I can do even better and faster in Vena.

“Lots of manual spreadsheets. Lots of heavy lifting. It was painful, disjointed and just not very efficient.”

That’s how monthly reporting felt for Ricardo Trigueros in the days before Vena. He knew he was ready for change, because as a Sr. Financial Analyst with Lookout—a cybersecurity SaaS firm—Ricardo always needs to deliver reliable financial statements to leadership quickly so his organization can prepare for any scenario.

“We weren’t getting reports out to executives until the third week of the month,” he recalls. “And when you’re that far off from real time, your numbers are going to be stale. Then it’s even harder to give leaders the insight they need to evaluate how the business is performing and ultimately make the best decisions.”

Ricardo and his teammates in finance were “scrambling” prior to Vena. Instead of spending their time exploring ways to make the business more profitable, they were inputting and validating financials in offline spreadsheets manually. They never had any time left ahead of their deadlines for meaningful analysis—making it tough to forecast key SaaS metrics such as LTV/CAC, churn and monthly revenue per product.

“There were times back then when I didn’t even feel like an analyst,” says Ricardo. “I was just another guy who could capture historical data and put it into a report.”

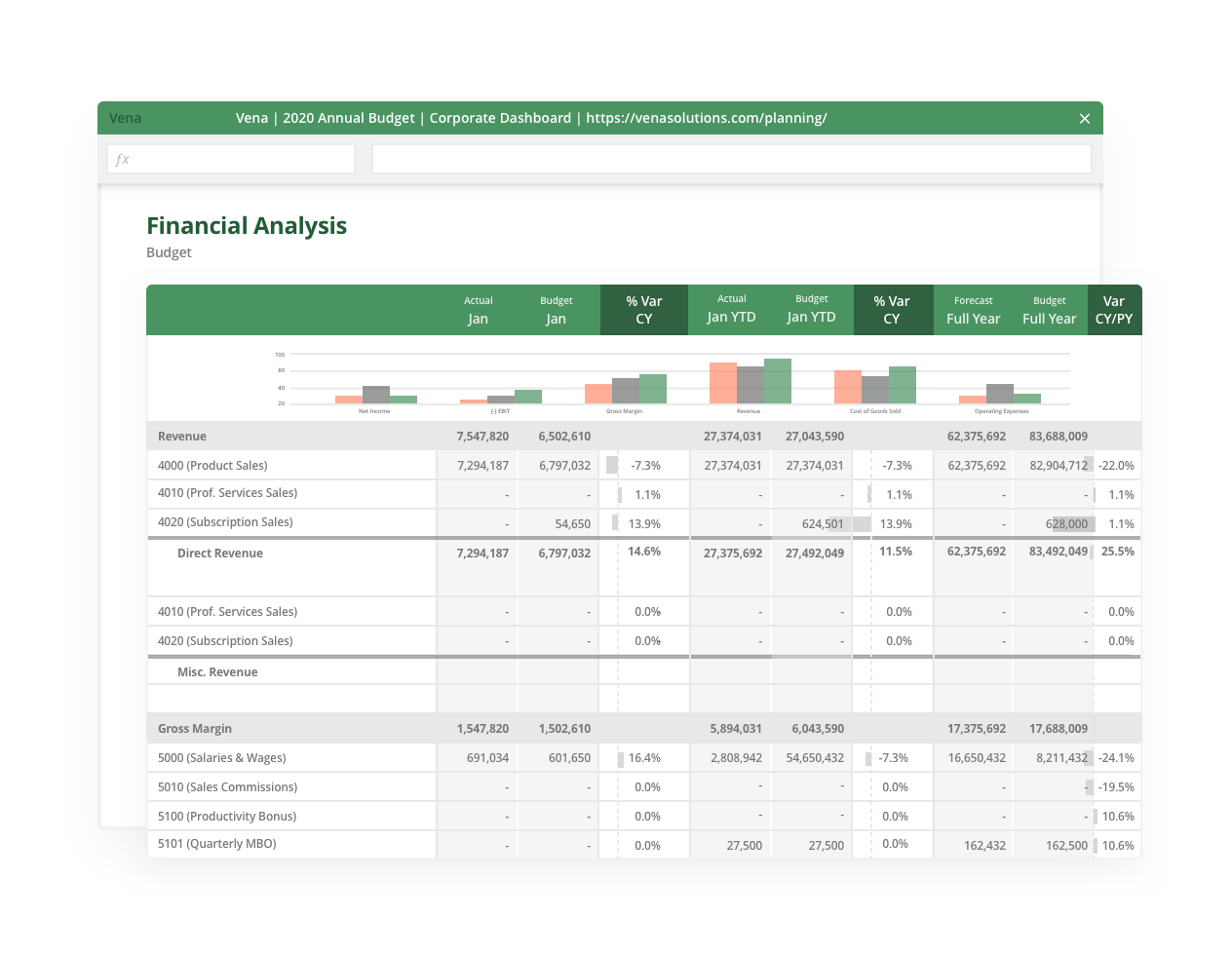

Ricardo launched Vena for SaaS in the fall of 2019 and quickly began streamlining Lookout’s P&L, balance sheet and cash flow statement delivery process. He was impressed right away by Vena’s native integration with NetSuite, which means financial statements now update nightly whenever new journal entries are approved in the ledger.

“It’s really awesome to know that I’m working from one source of truth with Vena,” says Ricardo. “We have billing data loaded from Salesforce and HR data from Workday in there too, so Vena provides a full picture of our entire business altogether. There’s never any hesitation about whether or not the data is right.”

Another big feature for Ricardo is Vena’s flexible scenario modeling capability, which allows him to test Lookout’s future KPI assumptions while keeping current budgets and forecasts intact. Vena’s Excel interface flattened the learning curve for his teammates as well because they can manipulate data seamlessly in an environment that’s naturally familiar.

“Version control issues are a thing of the past with Vena. I love how quickly we can iterate now and model any unique revenue scenario we can think of,” says Ricardo. “Vena really resonated with me as a finance professional right from the start—because any modeling I can do in Excel, I can do even better and faster in Vena.”

Now that he’s not juggling spreadsheets or keying in numbers manually anymore, Ricardo’s monthly reporting is done more than two weeks faster than before. He says it’s helped Lookout evolve into a more proactive, data-driven organization—because now the finance team looks forward instead of just validating actuals from the past.

“Vena has empowered my teammates and I to actually think like analysts again,” says Ricardo. “We’re not just scrambling to get reports out anymore. We’re actually helping our leadership make the important decisions that matter.”

One of those major decisions was at the onset of COVID-19, when Ricardo was tasked with rebudgeting for a 20% across-the-board expense reduction. Vena helped him model the cuts quickly with appropriate feedback from cross-functional stakeholders—ultimately ensuring that Lookout would make it through the pandemic unscathed. Now, they’re better prepared should another event like this happen again.

“Completely rehashing a budget like that would take a conventional FP&A team days. The value of Vena came through for us there because we only needed one day,” he says. “The time savings we’re experiencing with Vena are very real. I challenge other finance teams to rethink their planning processes and to invest in the right tools—because it really does pay off.”

Over 2,000 leading companies grow with Vena. Start your journey today