/Interest%20Earning%20Assets%20by%20Product.png?width=1446&height=738&name=Interest%20Earning%20Assets%20by%20Product.png)

/Interest%20Earnings%20by%20Product.png?width=1446&height=774&name=Interest%20Earnings%20by%20Product.png)

/Interest%20Bearing%20Liabilities%20by%20Product.png?width=1412&height=694&name=Interest%20Bearing%20Liabilities%20by%20Product.png)

/Income%20Statement.png?width=1359&height=748&name=Income%20Statement.png)

/Nominal%20Interest%20Rates.png?width=1438&height=775&name=Nominal%20Interest%20Rates.png)

/Power%20BI%20Dashboard%20Banking.png?width=1467&height=806&name=Power%20BI%20Dashboard%20Banking.png)

/Dashboard%20Retail%20Banking.png?width=1422&height=667&name=Dashboard%20Retail%20Banking.png)

/Return%20on%20Assets%20and%20Equity.png?width=1422&height=501&name=Return%20on%20Assets%20and%20Equity.png)

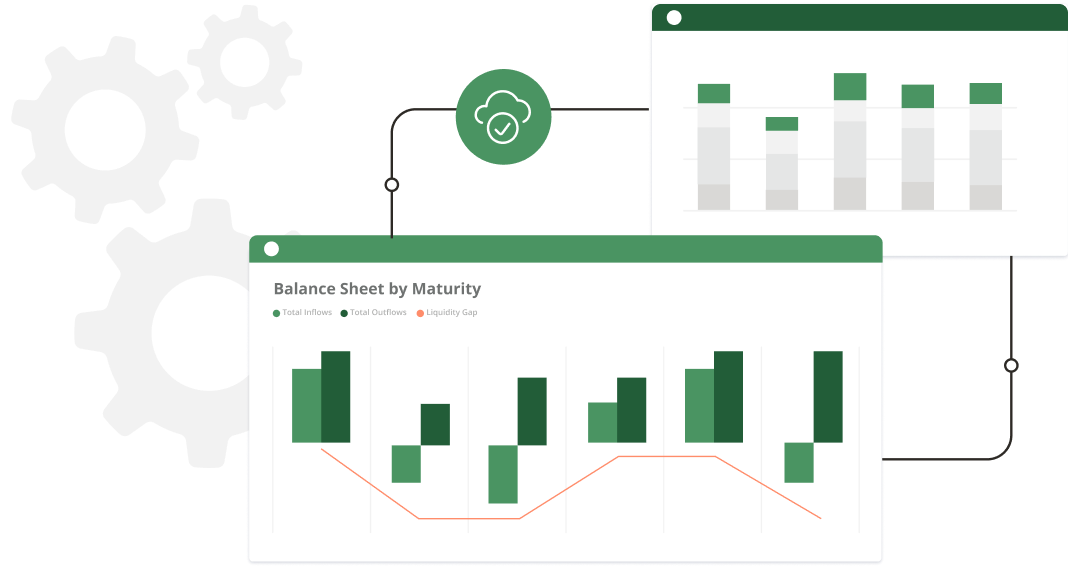

Watch how Vena streamlines the FP&A processes for organizations whose primary revenue stream is interest margins. Built on industry best practices, Vena includes integration to source systems, planning templates, comprehensive reporting and a collaborative workflow—all within the familiar Excel interface.

Learn how Vena can help your organization Plan for Anything.