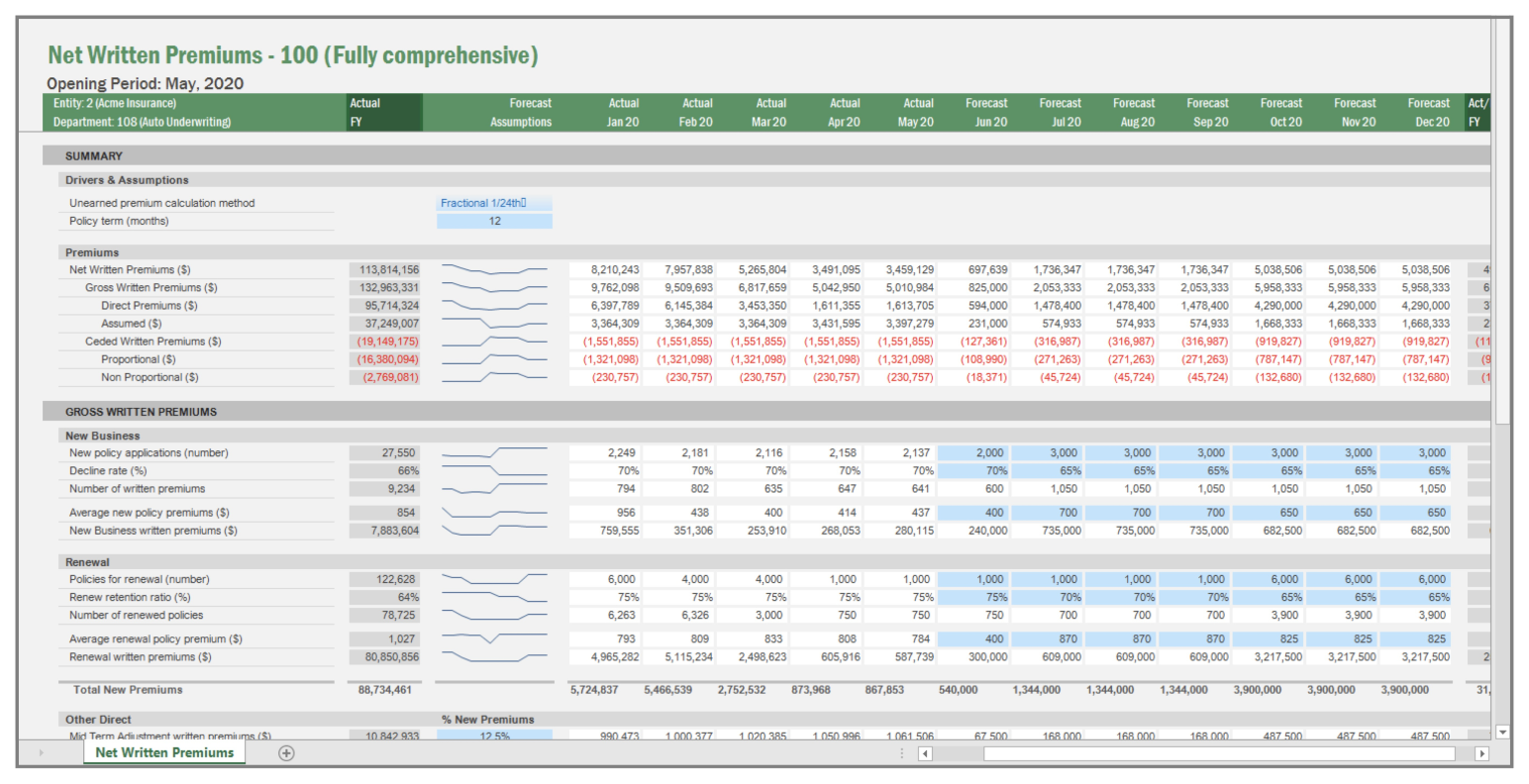

Input

Plan premium ceding, insurance underwriting, forecast acquisition costs and calculate losses

Modeling

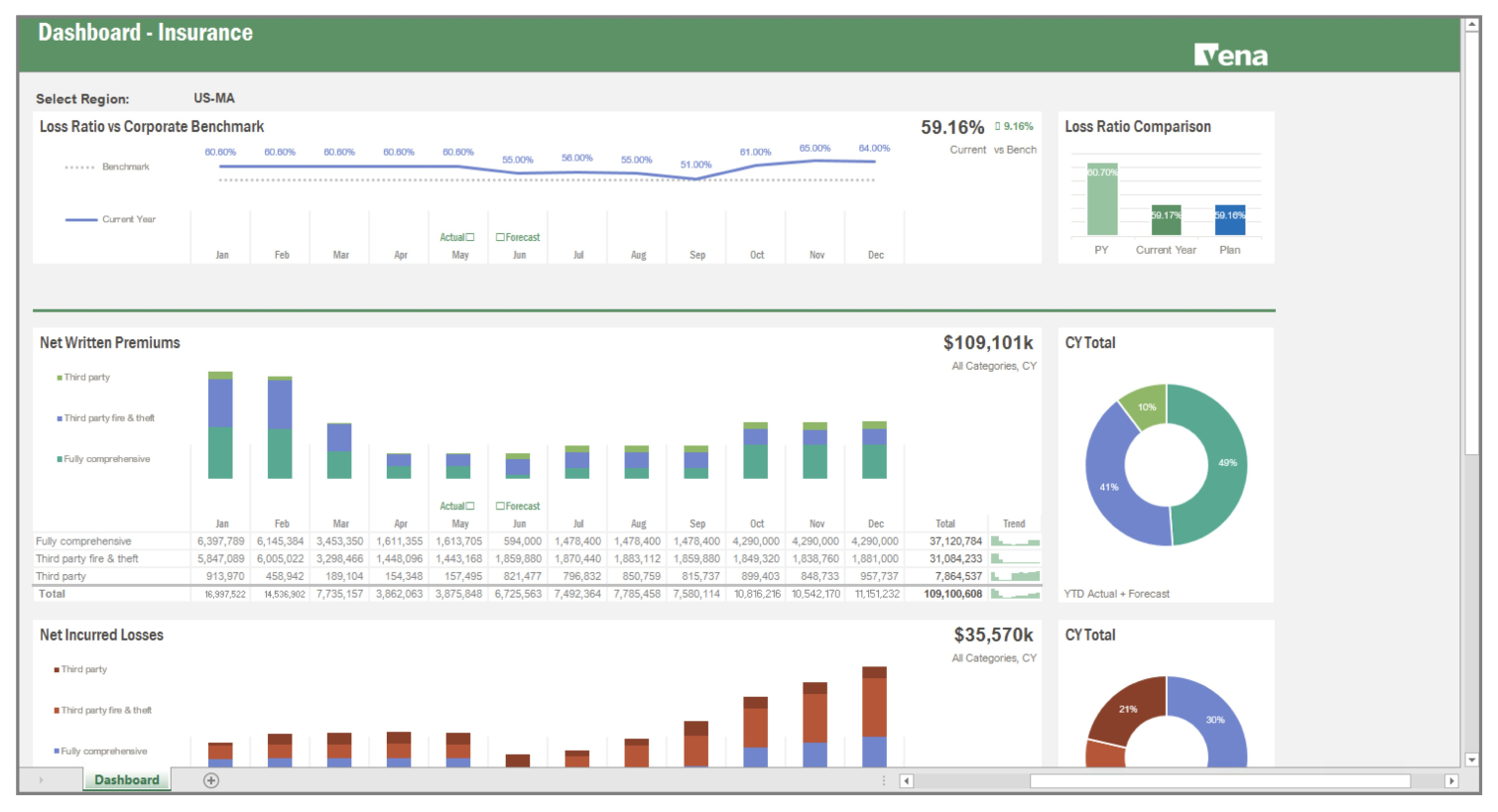

Use what-if analysis to see how changes to loss ratios, renewal rates and ceding ratios will impact margin

Reporting & Analytics

Create and distribute reports with just a few clicks—and easily compare your products and branch level profitability

.png)