Snapshot: Capstone Infrastructure

Independent Canadian power producer serving the clean energy sector with 24 facilities across the country

The company operates primarily in wind energy but also has solar, hydro, biomass and natural gas facilities

Integrations: Microsoft Dynamics GP for ERP

Vena has truly transformed our financial reporting capability and significantly reduced our errors and the time it takes to complete our financial close process. By setting up standardized and largely automated templates in Vena, we have cut our monthly close process in half.

Capstone Infrastructure Before Vena

An efficient and accurate close process is a priority for every finance team, especially if they’re reporting on multiple business units every month. But for Devendra Kalwani and his team at Capstone Infrastructure—a clean energy producer with 24 facilities across Canada—reconciling accounts and getting the books closed was a pretty painful process in the days prior to Vena.

“There were significant version control issues, data integrity problems and a lack of standardization,” says Devendra, Capstone’s Finance Manager. “We do our reconciliations on an entity-by-entity basis rather than on an account basis. Before Vena, it would take us approximately 10 business days to shut down our close process.”

Devendra’s biggest roadblock was preparing reconciliation packages for Capstone’s entities because everything was done using offline spreadsheets alone. In order to ensure an accurate month-end close and deliver consolidated financial statements for strategic, reliable analysis, his team would have to build those reconciliation packages manually—even printing them off in some cases. It caused plenty of long days and a lot of unnecessary headaches, making it tough to provide leadership with an up-to-date measure of Capstone's performance.

“This would take a lot of time to manually complete, and manual inputs are subject to human error,” says Devendra. “The month-end process just kept dragging on.”

The Vena Solution

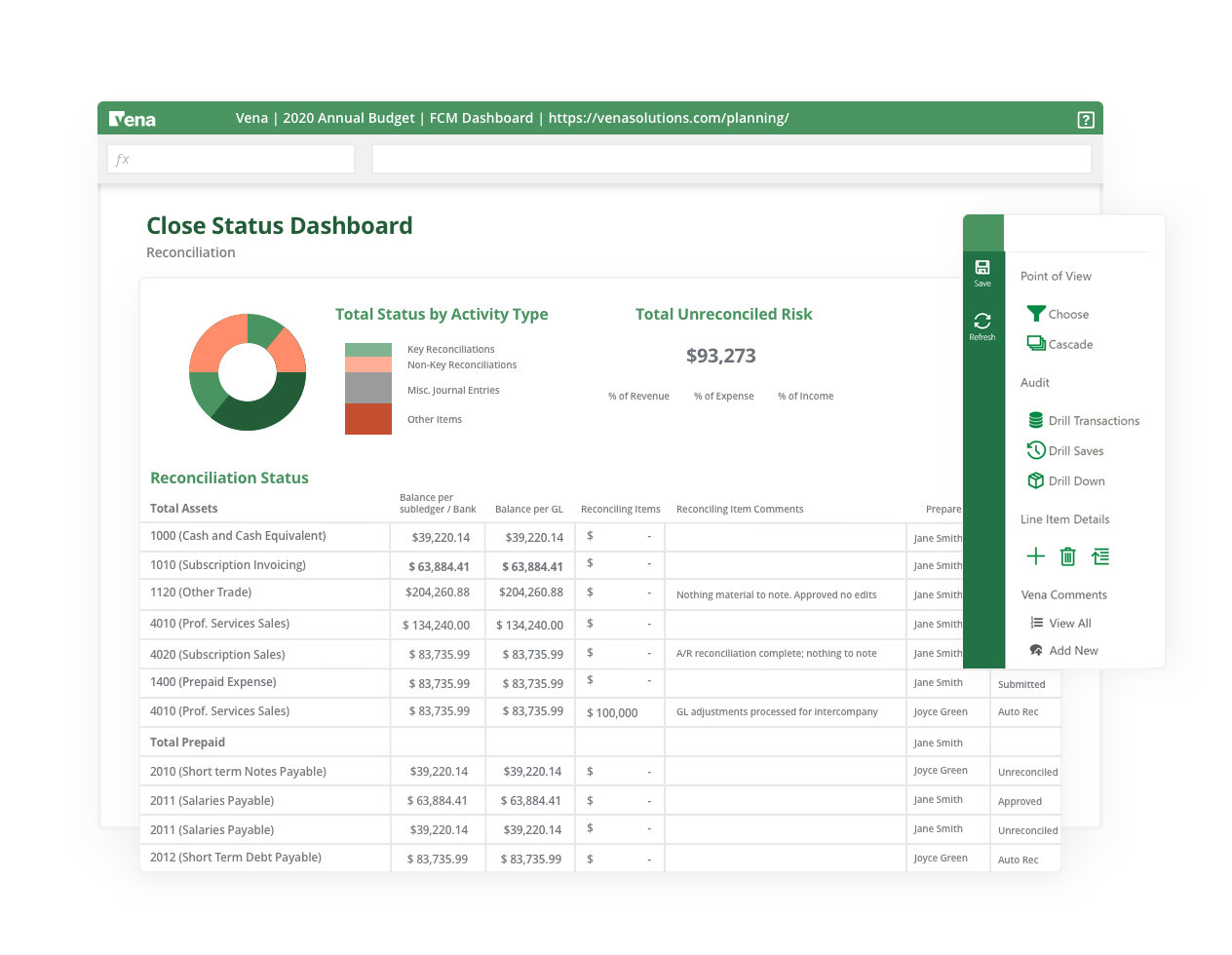

When he implemented Vena in 2015, Devendra’s primary goals were to improve data accuracy, reduce the time spent on reconciliation packages, standardize month-end reporting protocols and eliminate version control issues. Vena’s integrations with all of Capstone’s disparate source systems made it easy for Devenrda to bring the data he needed into a central database.

“Vena fulfilled all our goals that we set at the onset of the project,” he says. “Financial statement templates are ready with the click of a button. All data loads automatically from Vena, and all dates and formats update based on Excel formulas. If you have several subsidiaries in your business, Vena offers a functionality that allows you to toggle between any company financial statements you want to see very easily.”

Devendra was also impressed by Vena’s native Excel interface, collaborative workflows and advanced drill down functionality. Now his teammates are empowered with greater visibility into their numbers with an elevated sense of ownership throughout the financial close process.

“If there’s an account balance that doesn’t jive with their expectation, they can drill down to see every transaction that builds up to that balance,” says Devendra. “Users are able to catch journal entry errors prior to it coming to the reviewers, which as a reviewer myself has saved me a lot of time.”

Capstone Infrastructure With Vena

50% reduction in month-end close times, from 10 days to 5

24 / 7 access to up-to-date financial data causes fewer errors and enables standardized, automated financial statements

Expanded use cases beyond the office of finance now include agile operational planning, asset management and more

Key Results

Now that they’re free from tedious manual reconciliations and have all the data they need at their fingertips 24/7, Devendra and his teammates close the books 50% faster and produce more accurate financial statements at the end of each month. They've also realized efficiencies with their audits and quarterly reporting cadence.

“Vena has truly transformed our financial reporting capability and significantly reduced our errors and the time it takes to complete our financial close process,” he says. “By setting up standardized and largely automated templates in Vena, we have cut our monthly close process in half.”

But the most important benefit Capstone has seen with Vena has been a more strategic, data-driven role for the office of finance overall. Today, instead of spending his time reconciling data manually, Devendra can focus on driving value for the company through agile, finance-led business planning with the operations team and others—while also providing executives with the insight they need to make well-informed decisions.

“We spend more time analyzing data, and that’s how I believe our resources should be spent,” he says. “Having the business plan, automatic actual data and then reforecasting capabilities—all in one template with reliable GL data—has significantly expanded our use case. More and more operational data is starting to migrate into Vena. It’s kept me extremely busy this year, but it’s been a good challenge to take on!”

Ready to start your Growth Journey?

Over 1,300 leading companies grow with Vena. Start your journey today