FP&A

Tariffs, Turbulence and Market Unrest: How FP&A Teams Can Lead Businesses Through

How FP&A teams can play a pivotal role in guiding their businesses through new tariffs and the resulting market changes—and the tools that can help them do so.

Tariffs are reshaping the global economy, and according to experts, they could trigger a full-blown recession if left in place. Torsten Sløk, Chief Economist at Apollo Global Management, didn’t mince words in a recent CNBC interview:

“It’s all conditioned on tariffs staying in place at these levels, and if they stay at these levels, we will absolutely have a recession in 2025.”

But you shouldn’t wait for a formal recession to be declared—start managing cash flow like you’re already in one.

For CFOs and FP&A teams, this means moving beyond rigid planning cycles and outdated assumptions, protecting liquidity and ensuring operational resilience. The teams that prioritize cash flow management during a crisis will be the ones that stay ahead.

In this guide, we’ll share seven tactics for managing cash flow in the face of a looming recession.

In today’s volatile market, static forecasts break faster than they’re built.

When tariffs spike overnight, supplier costs increase, or customer payments slow down, monthly or quarterly forecasts are already outdated by the time they’re reviewed.

That’s why more finance teams are shifting toward rolling forecasts that update continuously with the latest financial and operational data.

“Gone are the days of the fixed annual budget,” says Vena Co-founder and Chief Solutions Architect Rishi Grover. “We now need to re-forecast on a much more frequent basis and be able to bring in your latest set of financial and operational actuals to help supercharge these models and also help support scenario modeling.”

Start by building a 13-week rolling cash flow model that updates every week or two, depending on how much volatility you're facing. The goal is to always have visibility into the next three months and to refresh that view regularly with your latest financial and operational actuals.

However, it’s not just about creating a forecast once, but revising it frequently, especially for your major expenses. When inflation spikes, supply chains shift, or tariffs change, the assumptions baked into an annual budget can become outdated within weeks.

Finance teams should re-forecast high-impact expense categories more often to catch gaps early, protect cash flow and avoid downstream surprises.

For rolling forecasts to be truly useful, you also need to move beyond static financial statements and into dynamic scenario modeling. For example, if you shift your hiring plan by 15% or see a 5% tariff hike on key inputs, your current forecast should show how that will affect:

Next month’s liquidity

Capital project timelines

Vendor payment schedules

“With current uncertainty around consumer behavior and input costs related to tariffs, we’re updating forecasts more often to understand our bottom line and liquidity impact,” says Pat Jones, SVP and Corporate Controller at PetIQ, a manufacturer and distributor of pet products. “Vena makes it much easier for us to run different scenarios, make changes and easily flow them through the data model at the appropriate level. This makes it easier to make updates around known changes faster.”

An example of a 12-month rolling forecast built in Vena.

An example of a 12-month rolling forecast built in Vena.

When recession pressure builds and cash flow tightens, holding onto cash just a little longer can improve liquidity and strengthen your financial position in uncertain times.

That’s why extending your Days Payable Outstanding (DPO)—the average number of days you take to pay suppliers—is one of the simplest, yet most effective ways to preserve liquidity.

However, delaying payments for too long can strain vendor relationships, cause operational delays, or even result in lost discounts. After all, the goal isn’t to delay indiscriminately, but to renegotiate more strategic terms and prioritize payments based on their business impact.

Start by segmenting your vendors to identify where you have leverage, such as through long-standing relationships or low-risk contracts, and where extra caution is needed. Preserving supplier trust is just as important as improving cash flow.

Then, explore options that will give you breathing room without burning bridges. For instance, consider:

Renegotiating Net 30 terms to Net 45 or Net 60 where appropriate

Prioritizing payments to strategic vendors while extending timelines on lower-risk accounts

Automating AP workflows to improve transparency, so suppliers know what to expect

It’s also important to look at DPO decisions in the context of your full cash position. If you don’t have clear visibility into your cash flow or don’t have an easy way to run driver-based models, this is a critical area you’ll want to address.

An example of a cash projection dashboard built in Vena.

An example of a cash projection dashboard built in Vena.

Let’s talk about the other side of your accounts: your receivables.

When cash flow is tight, receiving payments faster can be just as critical as slowing down payouts. That’s where optimizing your Days Sales Outstanding (DSO)—the average number of days it takes your company to collect payment after a sale—becomes crucial to maintaining strong liquidity.

To protect their cash position, finance teams need to become more proactive about collection cycles without damaging customer relationships.

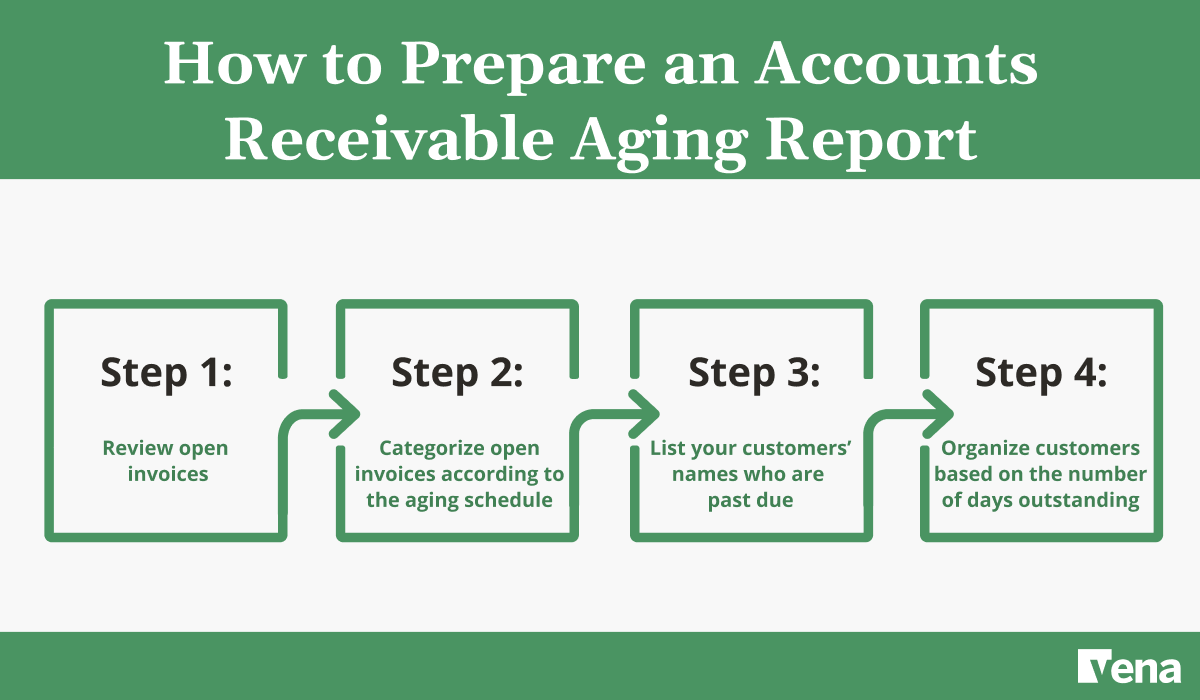

Start by segmenting your receivables by risk level, so you can prioritize outreach accordingly.

High-risk, habitually late accounts or aging accounts should trigger early follow-ups or even adjusted terms. Strategic customers with strong payment history, on the other hand, are better suited for flexible incentives, like small discounts for early payment

You should also:

Automate invoicing to reduce lag time between service delivery and billing

Set up reminder sequences or alerts as due dates approach

Integrate AR data with cash flow forecasts to better model timing gaps

Collections strategies are also something that can be scenario-tested. For instance, you could ask:

What happens to cash flow if our average DSO increases by 5 days?

Which accounts are driving the lag, and are they still low risk?

What would happen if we added a collections incentive for our top 10 accounts?

Vena’s free Plan for Anything Excel Template can help you build an overall projection of cash ins and outs from all your business activities. Use it to forecast collection timing, run "what-if" models and stay ahead of potential payment bottlenecks.

Another overlooked lever when it comes to protecting cash flow is your vendor agreements.

Many companies continue paying for tools and services they no longer need at the same scale, or that could be consolidated with others. And as budgets tighten, vendors are more open to renegotiation than you might think.

Reevaluating contracts gives finance and procurement teams a practical way to reduce costs without disrupting operations. During periods of economic uncertainty, every dollar spent must justify its value, and vendor contracts often hide more flexibility than most teams realize.

A vendor audit is a great place to start.

Pull a list of all active contracts, especially in categories like software, marketing, logistics, consulting, and facilities, and group them into:

Essentials that are actively used

Underutilized or duplicative services

Contracts with room for renegotiation or payment flexibility

Then, reach out to vendors with proposals for:

Requesting discounts tied to current usage levels

Downgrading to a lower-tier plan that still meets essential needs

Extending payment terms from Net 30 to Net 45 or Net 60 to free up short-term cash

Bundling upcoming renewals across products or teams for volume-based pricing

Converting annual contracts to quarterly payments if cash flow visibility is limited

Finally, review your service-level agreements (SLAs) to identify gaps between what you’re paying for and what you’re actually using. This approach reduces costs and improves payment predictability, vendor alignment, and budget discipline across teams.

During a looming or actual recession, you have to protect your profit margin as much as you cut costs. One of the most effective—and underused—ways to improve profitability is by analyzing which product lines are helping or hurting your bottom line.

However, some finance teams don’t examine product-level profitability closely enough, especially when it’s buried under rolled-up profit and loss statements or spread across multiple business units.

Now more than ever, your team needs visibility into:

Which product lines are high-margin vs. margin-draining

Which customers or SKUs (for retailers) are costing more to serve than they return

Where bundling, repricing, or even pausing production could free up capital

Start by pulling product- or service-level profit and loss statements. If you don’t have them, work cross-functionally with sales, operations and supply chain teams to build a picture of:

Direct costs (materials, fulfillment, packaging, licenses)

Indirect costs (marketing, support, returns)

Channel-specific expenses (distribution fees, commissions, discounts)

From there, identify your top 10 most and least profitable products. Then dig into what’s driving poor performance—is it thin margins, high cost-to-serve, or underpricing? You’ll want to flag SKUs with negative or near-zero contribution margins for closer review and explore pricing, bundling, or cost-saving opportunities within that group.

The goal isn't to cut blindly, but to protect the products that drive cash and profitability, and reallocate resources from those that don’t.

This gives you a clearer view of where profitability is strongest, where you’re losing ground, and where to take action, so you can double down on what works and rethink what doesn’t.

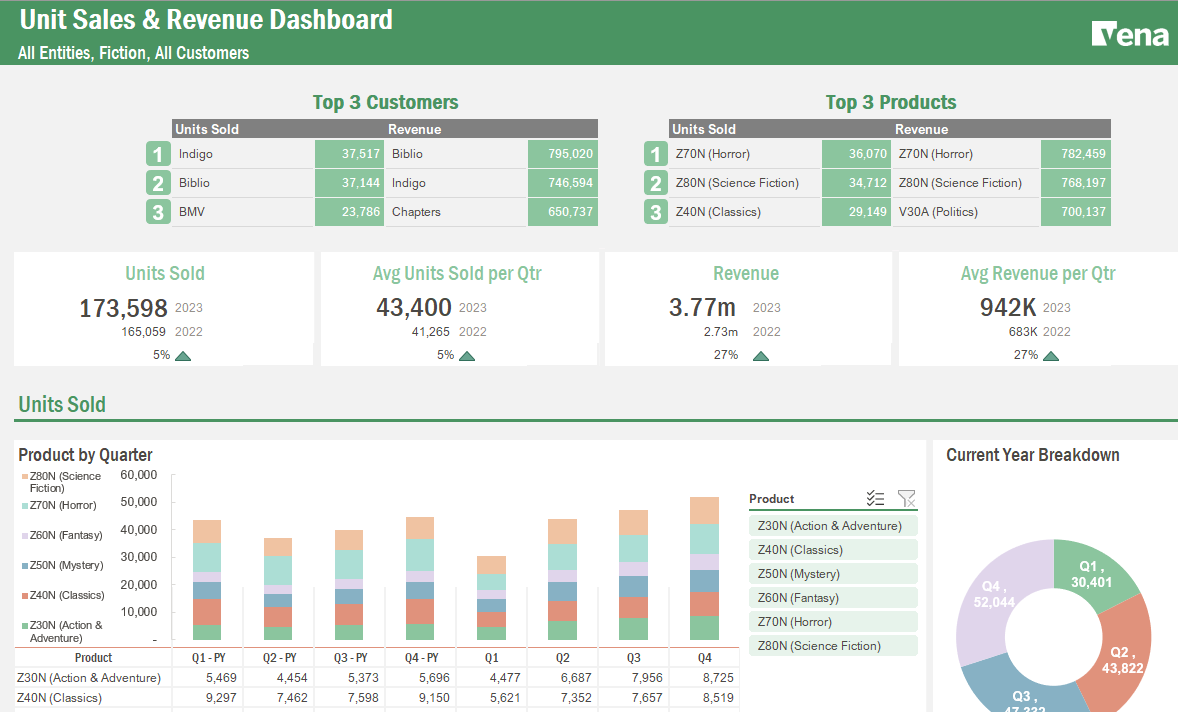

An example of a dashboard created in Vena that allows you to break down revenue by product.

The best cash flow strategies won’t go far if Finance is the only team thinking about them.

Even before a recession, it’s crucial to cultivate a company-wide mindset that views cash as the limited, high-priority resource it is. Of course, this doesn’t mean turning every department into a cost hawk. It means giving people visibility into how their choices impact the company’s financial health, and ultimately building alignment.

Effective, ongoing business partnering between finance teams and other departments is one of the best ways to achieve this.

Start by making cash visibility a company-wide conversation, not a siloed report. You could:

Share simple updates on cash flow health during leadership or all-hands meetings

Encourage department heads to include cash impact in project proposals or resourcing requests

Educate non-finance teams on key working capital levers like DSO, DPO, and how delayed collections or early spend can affect runway

Use internal wins as examples, highlighting when a team improved cash flow through strategic prioritization or renegotiation

The goal is to help everyone understand the bigger picture: in a tight economy, cash isn’t just king—it’s fuel. Because when teams are aware of how their everyday decisions impact liquidity, they naturally become more thoughtful about spending, timing, and the trade-offs involved.

When finance teams are under pressure, time becomes one of their most valuable (and limited) resources. Yet, many still rely on manual processes for tasks that could be automated.

Repetitive tasks—such as consolidating actuals from different systems, updating forecasts or chasing approvals across teams—can drain hours that should be spent on higher-impact work. That’s why finance automation is especially powerful during times of economic uncertainty.

Of course, automation doesn’t mean replacing the finance team. It means giving them more time to think strategically, respond faster and support the business with critical insights.

First, identify the manual and repetitive tasks that consistently slow down your team. Some tasks to automate include:

Copying actuals into forecasting models

Sending invoice follow-ups and payment reminders

Rebuilding monthly or quarterly reporting templates

Managing budget approvals via long email threads

Once you’ve mapped out the pain points, look for finance automation tools that:

Connect your source systems (ERP, CRM, payroll) to your planning models to eliminate double-entry

Automate approvals and workflows, so requests move faster without email bottlenecks

Standardize reporting templates with live data, so you’re not starting from scratch each cycle

Enable real-time collaboration so finance and business teams can work off of the same reliable data

AI is also a lever that finance teams should look to tap. An agentic AI solution purpose-built for FP&A such as Vena Copilot can help time-stretched finance teams reduce time spent digging through spreadsheets by drafting forecast commentary, suggesting variance explanations and answering complex questions in seconds.

The Association for Institutional Research (AIR) used Vena Copilot to eliminate time-consuming manual lookups and speed up report creation.

“[Vena] Copilot has reduced the time it takes me to complete recurring reporting tasks by at least 25%—possibly even up to a third in some cases,” says Charles McCumber, AIR’s Director of Finance. “I’ve measured the time saved on specific tasks and have consistently seen a 25% to 50% reduction.”

Cash flow visibility gets treated as a back-office metric—something to monitor, but not something to shape strategic conversations. That’s a mistake because revenue is not equal to cash. You can be profitable on paper and still run into issues if not managing cash closely, especially when market headwinds arise.

When cash flow visibility is front and center, your finance team can:

Stay proactive when plans shift

Make smarter tradeoffs across teams

Move faster when unexpected opportunities arise

So as you tighten budgets, renegotiate contracts, or revisit forecasts, don’t treat cash flow as a static report.

From rolling forecasts to product-line profitability, Vena provides your finance team with the flexibility, transparency, and collaboration they need to lead with confidence, even in uncertain times.

Use this template to project cash ins and outs from all your business activities.

Download NowMelissa Howatson, Chief Financial Officer at Vena, has a wealth of experience in financial and consulting roles, ranging from EdTech, automotive and Big Four accounting firms. She was CFO and board member at D2L—a global learning technology company—and led its successful initial public offering in 2021. Prior to that, she held finance leadership positions at Bend All Automotive, Qwalify and Primal. Melissa is a CPA-CA, having obtained her designation while working in KPMG's assurance practice. With her combination of scale-up and start-up experience, Melissa has an impressive track record of building and leading successful finance teams that drive the business forward.