Financial professionals have had only two options when managing FP&A spreadsheets for decades. They can stay the course and continue to use Excel as a stand-alone manual solution for financial planning and analysis.

Alternatively, they can replace spreadsheets with newer technology that presents long, disruptive integrations requiring extensive training.

Isn't there a better option?

Yes there is. Check out these integration suggestions if you're looking for ways to integrate your existing FP&A spreadsheets into a new financial planning and analysis solution.

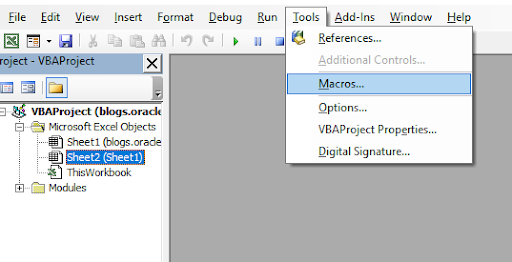

In FP&A, working knowledge of Excel is a must-have skill. Finance teams perform financial analysis, modelling and reporting in Excel because of its unmatched mathematical capabilities in formatting, calculations and VBA/Macro tools.

While some organisations have attempted to move away from Excel, 82% of organisations with an FP&A software solution will return to using Excel. Why force financial professionals to adjust to a new application?

Integrate an FP&A solution that works with your current spreadsheets, not against them. The result will be a more efficient finance team and happier finance folks. Let's look at the steps you should take to integrate spreadsheets into an FP&A solution.

Documentation is key for obvious reasons, including troubleshooting during the integration process y to determine which steps your integration team took. Consider outsourcing integration so it isn't something you or your internal teams have to worry about managing.

Furthermore, document the processes, procedures and objectives, along with change logs in the model. Separate into different tabs such as:

Instructions

Inputs

Outputs

Summaries

Drivers

Scenarios

Calculations

Change Logs

Assumptions

Source Data

Error Checks

Avoid externally linking workbooks or worksheets. If it is truly necessary, communicate all changes. Do not create a daisy chain of information. Refer directly to the data source for input instead of from cells that reference that input.

Excel's security is extremely limited. Data security will require that you encrypt the model to prevent unauthorised access and set permissions to keep unauthorised users from obtaining information outside the scope of their duties. Prevent fraudulent characters (internally and externally) from manipulating data.

You streamline integration by creating consistent formulas, such as model layouts, standardised naming conventions and structure. Do this for a range of mixed and absolute references.

Avoid inadvertently referencing incorrect data by pressing "Enter" after completing every entry into a cell. Don't simply click away from the cell. Also, mark "Final" on the final version to prevent further changes making the file read-only.

Approximately 63% of companies in the U.S. rely on Excel as the primary tool for budgeting and planning and most people are well-versed in using the program.

Spreadsheets are still our favourite for standard data entry or quick ad hoc tasks. Excel is straightforward to use and most people learn how to use it in their early secondary education classes.

More importantly, you can find free online how-to instructions, tips, and videos on social media platforms such as YouTube that discuss the effectiveness of spreadsheets. Spreadsheets are inexpensive. Proprietary spreadsheet programs like Excel (part of the Microsoft Office suite) are available as part of your Microsoft 365 SaaS subscription.

In 2016, Microsoft introduced Power BI tools. These tools allow spreadsheet users to manage a more extensive volume of data and enhance user experience with improved data visualization.

Many agree that Excel is obsolete, or at the very least, quickly becoming outdated. While people tend to exaggerate these claims, we base them on the undeniable truth that standard Excel alone is unfit as a total FP&A solution.

That's not to say that we don't believe that Excel has its strengths. There's a reason firms use spreadsheets to collect and store data.

However, modern FP&A teams require a toolkit that supports flexibility, scalability and collaboration. Standard desktop Excel falls exceedingly short, offering unreliable, chaotic and often siloed datasets.

Excel is also susceptible to human error. Data entry mistakes wreak havoc on even the best-built models and can lead to catastrophic circumstances.

Excel data is also susceptible to fraudulent manipulation and a lack of necessary security controls. Other issues include:

More importantly, developers did not design spreadsheets alone for generating analytics. Further integration is necessary for your financial team to perform business analysis.

Excel is here to stay. Overcome Excel's limitations by adding data integrity, version controls and up-to-the-minute updates with Vena--empowering.

your finance teams to obtain the data they need and perform the analysis you hired them to do without needing to teach them an entirely new way to manage spreadsheets.

As Senior Director of Content and Communications, Jonathan Paul leads content strategy and execution at Vena, overseeing the development of owned media and content experiences that help finance professionals fuel business health, as well as their personal and professional growth. When he's not dreaming up new ways to offer audiences value through content creation, Jonathan loves to lose himself in an immersive video game with a solid narrative, lose golf balls pretending to be good at golf and lose time dreaming about time travel.