Calculating your company’s income tax liability for the current year isn’t always straightforward.

Tax laws can shift—like the federal rate change from 15% to 21% in 2018—forcing companies to adjust their financial reporting accordingly. On top of that, income is often recognized differently for accounting and tax purposes, which finance teams must reconcile to get an accurate tax figure.

Manually managing all this not only takes time but also increases the risk of errors. Inaccurate filings can result in hefty penalties—up to 20% of the underpaid tax.

That’s where tax provisioning software comes in. It helps streamline the process by pulling data from various systems and automating calculations, reducing risk and improving accuracy.

In this article, we’ll explain how U.S. businesses can calculate their income tax liability and how the right software can make tax provisioning more efficient and reliable.

Tax provisioning is the process of estimating how much income tax your company has to pay to the IRS for the current year based on projected income.

This process ensures your company's financial statements:

This way, you can better plan for tax season and manage your tax liabilities.

The US tax provisioning process is different from that of Canada and the UK. Each country has its own set of tax laws and rates, which can change over time.

If your company is based in the UK, be sure to read our UK tax provisioning guide.

But if your business is based in the US, keep reading to learn how to estimate how much you’ll need to set aside for income tax.

ASC 740 applies to all entities (domestic and foreign) that are consolidated in the financial statements of a US company that follows GAAP and has income tax obligations in the US.

ASC 740 is a US GAAP standard that governs how you recognize, measure and present income tax assets and liabilities in your company’s financial statements. Its application depends on your entity's type, size and reporting framework.

Let’s say XYZ Corporation is a publicly traded company with two subsidiaries,

In this case, ASC 740 applies to the parent company, XYZ Corporation, because it prepares consolidated financial statements. It also applies to

For US-based businesses, corporate income tax provisioning is typically calculated this way:

Corporate Tax Provision = (Taxable Income × Tax Rate) + Buffer Amount (Optional)

Pro tip: US tax laws and regulations are complex and subject to frequent changes. To stay updated and avoid penalties, always check official sources like the US gov website or IRS official site for the most recent updates.

Additionally, use tax provisioning software to accurately calculate your income tax provisions (taking into account various tax rules, deductions and credits).

This way, you’ll save time, minimize errors in your tax reporting, and stay compliant with current tax laws.

To calculate your total ASC 740 income tax provision, use this formula:

ASC 740 Tax Provision = Current Income Tax Expense + Deferred Income Tax Expense

But, you’ll have to calculate the value of each one separately before adding them.

Here’s how to do it.

.jpeg?width=1430&height=2946&name=vena-blog-image1-US_Tax_Provisioning_Guide%20(1).jpeg)

To find your company’s current year income tax expense, follow these steps:

To get an accurate estimate of your ASC 740 current year income tax expense, you’ll need to gather your company's financial information, including:

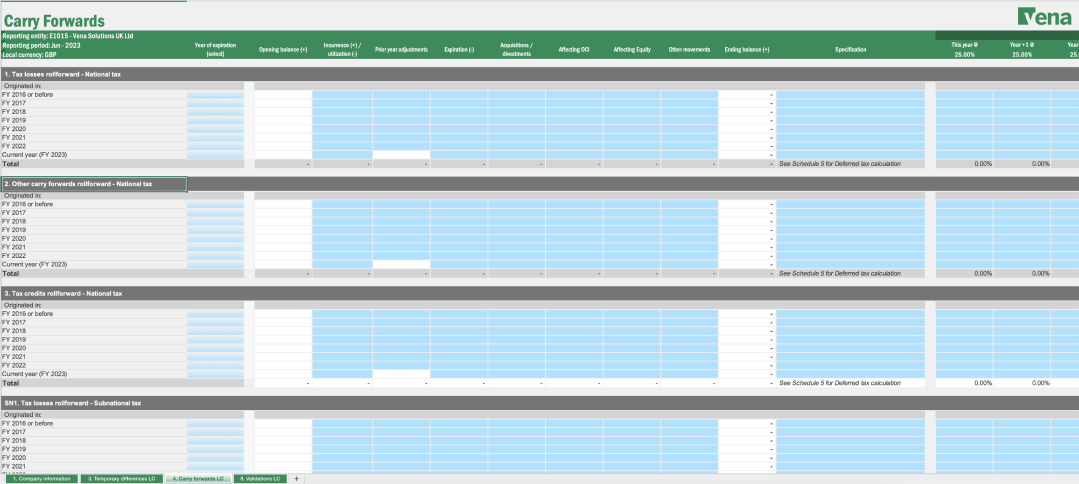

Vena makes it easy for you to source this information, as we integrate with your various source systems such as your ERP, general ledger, sub-ledgers and other tools, creating a single source of truth. Our tax provisioning software also includes pre-built templates to make it easier to track temporary differences and carryforwards.

Pre-tax GAAP income (or book income) is typically included in your company's financial statements, which are prepared according to GAAP standards.

To calculate it manually, use this formula:

Pre-Tax GAAP Income = Total Revenue - Total Expenses

With Vena, you can find your actuals for this calculation easily, with pre-built templates for critical reports like your P&L statement and operating expenses populating with the latest data from your ERP and GL systems in real time.

Permanent differences are discrepancies between your taxable income (used for tax purposes) and book income (used for financial reporting).

These differences happen because there are separate rules for calculating income for financial reporting (under GAAP) and tax purposes.

Common examples of permanent differences include:

To reconcile them, add or subtract any permanent differences from your pre-tax GAAP income.

Temporary differences are gaps in your tax accounting and book accounting that balance out over time due to variations in timing.

Say a company follows the accrual basis for financial reporting, recognizing revenue when it's earned, even if the cash payment hasn't been received. But for tax purposes, revenue is recognized when the payment is received.

This creates a temporary difference—a discrepancy between when an item is recognized for tax purposes and for accounting purposes, or methods your team used to recognize income and expenses.

Some common examples of temporary differences include:

To identify temporary differences, compare your GAAP income tax calculation with the current year balance sheet.

To calculate the net change, add all the temporary differences, either by increasing or decreasing your taxable income compared to your GAAP income: If the net change of all the temporary differences results in higher taxable income in the future, add it to your current taxable income. But if it leads to lower taxable income, subtract it.

Repeat the same process for your accounting income.

If your company has net operating losses (NOLs) from prior years and has carried them forward for tax purposes, you can offset future taxable income with it.

NOLs occur when your company's allowable tax deductions exceed its taxable income for a given period. If your business incurs losses during a tax year, it can use those losses to reduce its taxable income in other years.

If your company has usable loss carry forwards available, subtract the amount of these losses to reduce your taxable income.

Vena for Tax Provisioning includes a pre-built template to help you manage carry forwards.

Apply the relevant income tax rate (e.g., 21% for C Corporations) to your taxable income. If you have additional taxes, such as state and local income tax, calculate them separately and add them to your income tax liability.

Tax credits are incentives the U.S. government offers businesses to reduce the amount of tax owed. Some examples include

Find out tax credits you qualify for based on your tax situation and the total value you’re eligible to claim.

Also, find out other adjustments, deductions, or allowances that you can claim. These often include deductions for business and office supplies. Then, subtract the total value from your income tax liability.

Check to see if your business has any unused tax benefits from past years that can be considered in the current year's tax calculations.

Also, evaluate whether certain tax benefits claimed in the current year are likely to be sustained upon review by tax authorities.

If you’re uncertain about the tax treatment of specific items, make accruals for potential tax liabilities.

Finally, subtract the total tax credits and adjustments from the tax expense you calculated in Step 6. This will give you the current year's income tax expense for your ASC 740 provision.

.jpg?width=1430&height=2671&name=vena-blog-image2-US_Tax_Provisioning_Guide%20(1).jpg)

Deferred tax expenses arise from differences between accounting income and taxable income that will reverse in future periods.

These differences can result from various factors, such as revenue recognition timing, depreciation methods, and the treatment of certain expenses.

When you recognize a temporary difference, this means you realize that your company will have to pay taxes on certain income in the future. Or, it’ll be able to reduce its tax liability in the future due to deductible amounts.

This ensures that your financial statements accurately reflect the expected tax consequences of these differences over time. It also gives stakeholders a clear picture of the company's financial position and performance.

Follow these steps to calculate your company’s deferred tax expenses:

Estimate the amount by which your taxable income will exceed or fall short of your accounting income when the temporary difference reverses.

If the temporary difference leads to higher taxable income when it reverses, it becomes a deferred tax liability. But if lower, it is a deferred tax asset.

The formula for calculating deferred tax liability is as follows:

Deferred Tax Liability = (Future Taxable Amount − Book Value) × Tax Rate

Repeat the previous step, but this time, apply it to deductible temporary differences and any loss carryforwards using this formula:

Deferred Tax Asset = (Book Value − Future Taxable Amount) × Tax Rate

If you have any tax credit carryforwards from previous years, add it to reduce your future tax liabilities.

A valuation allowance is a reserve you should set aside in case some of your deferred tax assets can’t be used to reduce future tax payments. It ensures financial statements accurately reflect the uncertainty around deferred tax assets.

If there’s a 50% or less probability that a particular part of the deferred tax asset will be used to reduce future taxes, make a valuation allowance for it.

This way, you avoid overstating your financial position and accuracy penalties, which is up to 20% of the extra tax due.

Subtract the net deferred tax position at the beginning of the year from the one at the end of the year.

(Net deferred tax position is the overall balance of deferred tax assets and deferred tax liabilities on a company's balance sheet.)

Here’s the formula:

Deferred Tax Expense = Net Deferred Tax Liabilities − Net Deferred Tax Assets

This accounts for changes in deferred tax liabilities and assets during the year.

Include the deferred tax expense in your company’s income statement and disclose the deferred tax liability or asset on your balance sheet.

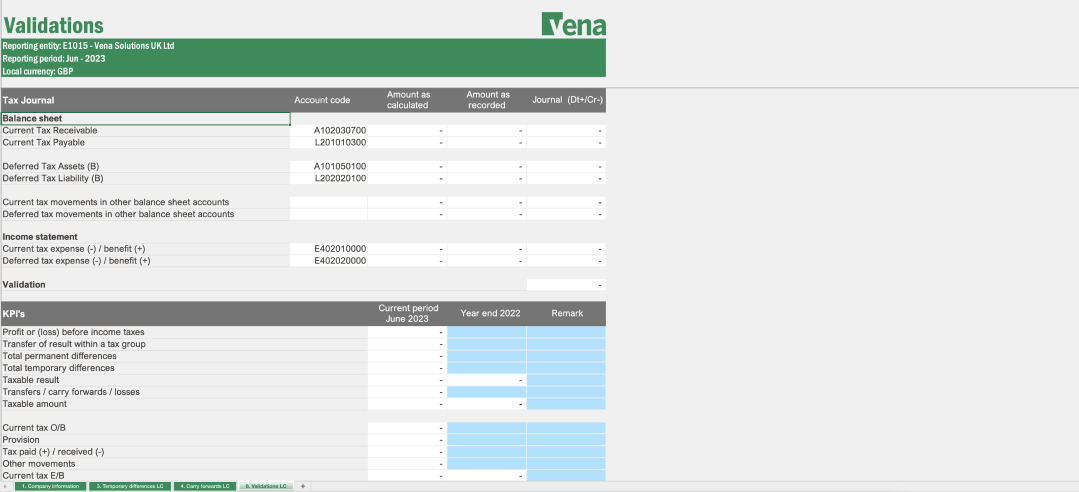

With Vena for Tax Provisioning, you can easily keep tabs on your deferred tax assets, deferred tax liabilities, permanent differences and temporary differences—sourcing values directly from your balance sheet.

There are many reasons why tax provisioning is a tedious process for US companies. But we’d say the top five reasons are:

Tax provisioning software can help you manage these challenges, however. Vena, for example, can help you automate complex tax calculations and delegate tasks across your team as you manage the process.

But there are even more reasons to be using tax provisioning software. Let's go over four of them.

Tax provisioning software that integrates with your core source systems like your ERP, HRIS and payroll systems can help with automating the data entry process.

This reduces manual work, and in turn, eliminates errors that could lead to regulatory penalties as you don’t have to copy and paste data anymore.

Vena takes things a step further, with automated tax calculations. Your tax department can input the business’s current year income tax and deferred tax into Vena, where it’s used to automatically calculate your current year tax provisioning.

"The benefits of tax provisioning software are threefold; everyone starts off using the same data set as a baseline, automation reduces human error and differences can be easily identified and reconciled. This results in more speed and accuracy in the financial close process."

Andrew Chubb, Director, Solutions Consulting at Vena Solutions

Federal, state, and local tax laws are subject to frequent changes, which can be challenging for finance departments to keep up with.

.jpg?width=1430&height=1321&name=vena-blog-image3-US_Tax_Provisioning_Guide%20(1).jpg)

The corporate tax rate in the US currently stands at 21%, most recently updated from 35% in 2018.

Tax provisioning software can help you adapt quickly should tax rates change. For instance, Vena templates are easy to update — if applicable tax rates change, you can simply update your key drivers to reflect this and the data will repopulate for you.

Tax provisioning software like Vena that integrates with your core source systems like your ERP, GL, subledgers, HRIS and payroll systems provides you with a single source of truth for your tax processes.

Authorized team members can easily access the data they need from one central location and reduce the time spent searching multiple platforms. Plus, any updates you (or your team) make in your accounting or ERP software are immediately reflected in the tax calculations.

When it comes to tax planning, you need to be able to understand exactly where a particular number came from.

With the drill down function in Vena, you can see exactly when a value in your report changed and who changed it, giving you a complete audit trail.

This is especially helpful when analyzing trends and changes in tax liabilities, so you can easily compare data for different periods.

You and your team can save time to focus on more strategic tasks by automating repetitive tasks with tax provision software.

Learn how Vena can help you do this, so you can make accurate tax provision estimates and accelerate the financial close process.

Tax provisioning ensures your company's financial statements accurately reflect your current and future tax liabilities. This way, stakeholders can see a true and fair picture of your company’s financial health.

There are five key challenges US companies face when it comes to the tax provisioning process:

Here are five key items of documentation necessary to complete your tax provisioning in the U.S. and defend your tax positions in case of audits or inquiries:

Grow Your Career With Access to Free CPE/CPD Courses & Certifications.

Start LearningJessica Tee Orika-Owunna is a content strategist and writer with over seven years of experience creating and repurposing relatable, helpful content for global brands including Contentsquare, Softr, Hotjar and Vena. She specializes in turning everyday product, user, and subject matter expert insights into product-led content that answers real buyer questions and supports better business outcomes.