Accuracy is the foundation for reliable financial reporting.

And the financial close process ensures as much, as your team thoroughly reviews and reconciles financial data to ensure all transactions are properly documented.

But this isn’t easy to achieve, as tax and accounting teams often have conflicting priorities and different ways of classifying transactions.

This misalignment results in errors in your financial statements, attracting fines and penalties ranging from 5% to 30% of the extra tax due.

Fortunately by using tax provisioning software, you can reduce the likelihood of these mistakes, ensuring that your financial data complies with UK accounting standards and tax regulations.

This way, your business can confidently set aside the right amount you’ll need to pay in taxes.

In this comprehensive guide, we’ll break down how UK businesses should estimate the tax they will owe for the current year and the complexities that lead to misalignment between tax and accounting teams.

If your business is based in the US, be sure to check out our US tax provisioning guide.

We’ll also show you how tax provisioning software helps to reduce risk and increase efficiency in tax provisioning.

Tax provisioning is the process of estimating and setting aside the income tax your company has to pay to HMRC for the current year.

The goal is to help you plan better and show the right amount of tax you owe in your financial reports.

Given that your team won’t have the exact figures for your business’ total profits or the applicable tax rates until the fiscal year ends, you have to rely on estimates to calculate tax provisions. Many companies even add a buffer amount to avoid understating their taxes.

This proactive approach safeguards your business from penalties related to late taxes or inaccuracies in reporting tax liabilities, ensuring you stay compliant.

Income tax is calculated using this formula:

Corporate Income Tax = (Taxable Income × Tax Rate) + Buffer Amount (optional)

Taxable income is the sum of your company’s net income (total revenue minus allowable expenses) and net chargeable gains (total profit from selling capital assets like property, stocks or equipment).

As of this writing, the standard tax rates for UK companies are

(Marginal relief ensures companies with profits in this bracket receive a gradual adjustment in their tax rate. The amount of marginal relief decreases as profits move closer to the upper limit of £250,000.)

The buffer amount is an optional precautionary measure you can add to account for uncertainties and prevent underestimating tax liabilities.

Pro tip: Tax laws and rates are subject to change, so you should always check official sources like the UK government website for the most recent updates.

Also, calculating your income tax isn’t always a straightforward process—it often involves additional factors and deductions. Consider using tax provisioning software to speed up the process, avoid errors and stay compliant.

An overview of the entire process of calculating your business’ tax provision for the current year. We delve into each of these steps below.

There are two amounts you must calculate to get accurate tax provision estimates for your business:

Let’s go over how to calculate each one.

To calculate your company's current income tax expense, follow these steps:

Calculate your company's net income using the formula:

Net Income = Total Revenue - Total Expenses

But it's not always straightforward; you may need to adjust and classify things correctly according to GAAP standards.

To ensure you’re complying with UK regulatory requirements, it’s especially important that you have an audit trail of all updates made to your financial reporting (which is where a software like Vena can help).

To align your book estimate of net income with the tax calculations, you’ll need to add or subtract any permanent differences.

Permanent differences are discrepancies between taxable income (used for tax purposes) and book income (used for financial reporting).

These differences arise because certain items are treated one way for tax purposes and another way under GAAP.

Some examples of this include:

This helps reconcile the differences between how income is calculated for financial reporting and taxation.

Temporary differences are timing differences between when an item is recognised for tax purposes and when it is recognised for financial reporting purposes.

Say a company follows the accrual basis for financial reporting, recognising revenue when it's earned, even if the cash payment hasn't been received. But for tax purposes, revenue is recognized when the payment is received.

This creates a temporary difference, as the timing of recognizing revenue differs between financial reporting and tax obligations.

The difference will remain until the criteria for recognizing revenue aligns for both financial reporting and tax considerations.

Other examples include:

To identify temporary differences, you’ll compare your GAAP income tax calculation with the current year balance sheet.

The formula for current year taxable income is:

Current year taxable income = Pre-tax income – (Permanent Differences + Temporary Differences)

This gives you the taxable income for the current year after considering both permanent and temporary differences.

Subtract any available tax credits and NOLs from your current taxable income.

Tax credits are incentives that reduce the amount of tax owed (such as research and development tax credits). On the other hand, NOLs represent losses that can be used to offset future taxable income (such as business downturns).

To calculate your current income tax provision, use this formula:

Current tax expense = {Current year taxable income – (Net operating losses + Tax credits)} x UK Federal tax rate

As we covered earlier, the tax rate is the percentage of taxable income a company must pay as taxes (which varies based on your organisation’s earnings).

Calculating deferred tax expenses involves recognising the differences between accounting income and taxable income that will reverse in future periods.

Let’s say your company uses a method to calculate profits for taxes that allows it to pay a bit less tax now but more later.

Deferred tax expenses are about realising and accounting for the fact that, eventually, the company will have to pay the balance it saved earlier. It's a way of making sure the books align in the long run.

Here are the steps to calculate your company's deferred tax expenses:

For each temporary difference, calculate the future taxable amount that will result from the reversal of the temporary difference.

This involves considering the applicable tax rates that will be in effect when the temporary differences reverse.

If the future taxable amount is greater than the book value, it results in a deferred tax liability. If the future taxable amount is less than the book value, it results in a deferred tax asset.

The formula for calculating deferred tax liability is:

Deferred Tax Liability = (Future Taxable Amount − Book Value) × Tax Rate

For calculating deferred tax asset, the formula is:

Deferred Tax Asset = (Book Value − Future Taxable Amount) × Tax Rate

Where:

The deferred tax expense is the the adjustment or difference that occurs in the deferred tax amount over time.

The formula for deferred tax expense is:

Deferred Tax Expense = Change in Deferred Tax Liabilities − Change in Deferred Tax Assets

Include the deferred tax expense in the income statement and disclose the deferred tax liability or asset on the balance sheet.

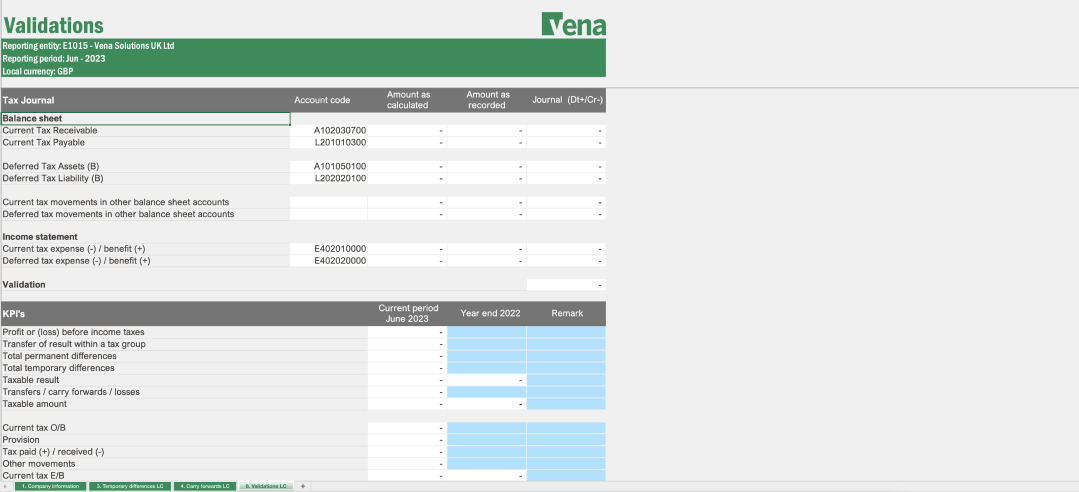

With Vena for tax provisioning, you can easily keep tabs on your deferred tax assets, deferred tax liabilities, permanent differences and temporary differences—sourcing values directly from your balance sheet.

Corporation tax laws in the UK are not set in stone; they often change.

For example, the tax rate, which was 28% in 2010, dipped in 2017 to 19%, and it’s now at 25% at the time of this writing.

Now, imagine if your tax and accounting teams made tax estimates before the most recent change this past April. It’d mean their initial estimate won’t align with the actual tax liabilities. They’d have to go back to Excel to redo all calculations and revise their financial statement, which is a time-consuming and frustrating process.

Governments may also introduce new regulations or modify existing ones.

This dynamic nature of GAAP and income tax rules makes it hard for your teams to predict the exact amount they need to set aside for taxes and stay compliant.

Host monthly, quarterly or semi-annual information sessions to update your team on recent tax law changes, what they mean and how the updates affect their work.

Alternatively, invest in creating content for your internal communication channels or newsletter (if you have one) that covers the latest tax laws, including changes in rates, new deductions or alterations to reporting requirements.

Use real examples to show how these changes will impact different use cases.

For example, you could simulate how a change in tax regulations will affect your company's financial statements, tax liabilities and different departments in your organisation (operations, HR, legal and compliance, marketing and sales).

Also, make learning an ongoing process—consider creating a centralised repository (or internal company wiki) on Sharepoint, Google Drive, Notion, or any tool you prefer.

Your company wiki should include useful internal documents or links to external resources your team can always refer to stay informed.

Clearly articulate guidelines and best practices within the documentation and include information on compliance requirements, industry standards and any specific considerations for accurate financial reporting.

Tax and accounting teams often operate with distinct roles and focus areas.

While the tax team ensures your company follows tax laws and pays what it owes, accounting teams record and summarise financial transactions to show how the company is doing financially.

As a result, they both interpret money differently—the tax team focuses on the timing of transactions, and the accounting team focuses on the impact of your financial activities.

"Tax and accounting teams operate on different timelines, each having its own deadlines. This leads to timing differences in recognising income, expenses and liabilities. Both also deal with different standards that can change frequently; one deals with IFRS and GAAP, and the other deals with tax regulations. With all these different rules, it’s not long before the account and tax departments are dealing with very different numbers. Any failure to reconcile these differences leads to discrepancies in financial reporting."

Andrew Chubb, Director, Solutions Consulting at Vena Solutions

Conduct joint planning sessions before major projects start or during key periods such as tax season.

Invite key stakeholders from your tax and accounting teams to these sessions. This could include tax experts, accountants, project managers and other people directly involved in the process.

During these sessions, the team should:

You could also create a visual representation of the end-to-end workflow for these tasks. Outline each step involved, starting from data collection to the final reporting.

Clearly define the roles and responsibilities of team members at each stage of the workflow and the handoff points between the tax and accounting teams.

Pro tip: When you create a workflow within Vena—for any process from budgeting to financial close and tax provisioning—the steps you create can be mapped to actual tasks that will automatically notify the individual responsible.

To keep everyone on the same page and maintain data integrity, create templates for financial reports, checklists for compliance reviews, and standardised formats for data submission or other common tasks.

Tax provisioning involves collecting, processing, and analysing data from various departments to calculate and report tax liabilities.

When software and systems (such as your ERP, subledger and GL) aren’t integrated, it creates data silos.

As a result, the tax team will need help accessing accurate and timely financial data from the accounting department. This slows down the tax provisioning process, as the team can only access incomplete or outdated information.

With Vena, you can account for taxes directly in your revenue reporting. The example above shows how you might account for taxes relating to a specific department such as Marketing.

Invest in a complete planning software that imports data from your existing systems across all departments into a central database.

This eliminates the need for manual data entry and transfer between systems and frees up more time for your teams to focus on strategic tasks.

Choose a unified platform that consolidates financial data, budgeting, forecasting, tax provisioning and reporting functionalities. This eliminates the need to alternate between different tools and reduces the likelihood of data silos.

Also, ensure your software solution lets different departments customise it to meet their unique needs. And be sure it’s easy to use regardless of their background or experience level or that your solution provider has a knowledge base or academy to help your team self-onboard and learn to use the tool faster.

Temporary differences arise when there is a mismatch between the timing of recognising items for financial reporting purposes and tax purposes.

When the estimates of these differences are inaccurate, it leads to errors in calculating the breakdown between current and deferred income tax liability, which affects the entire financial statement.

Beyond tax penalties, misleading financial statements affect stakeholders’ decision making, which relies on accurate data.

Regularly monitor and review temporary differences, especially in the context of changes in the business environment, tax laws or accounting standards.

This ongoing review lets you make timely adjustments and ensures that estimates remain accurate and reflect current circumstances.

Economic conditions can be unpredictable due to factors such as geopolitical events, changes in government policies, or global economic trends.

Sudden and unpredictable changes in stock prices, currency values, or commodity prices also make predicting profits challenging, as pricing and demand for products or services are subject to rapid and unexpected shifts.

These market fluctuations can significantly impact companies’ financial outlook, as they’ll be unable to accurately forecast and plan for their tax obligations.

Use scenario planning to anticipate and reduce risks in tax provisioning.

This lets you analyse the impact of potential changes to revenue, expenses and cash flow. This way, you can prepare for how these different economic scenarios will affect your taxable revenue.

Structural changes, such as mergers, acquisitions or changes in legal entity structure, often introduce uncertainty about future tax implications.

For example, changes in the ownership structure or business operations impact the utilisation of NOLs and other tax credits.

The complexity lies in predicting how these changes will affect your company's taxable income, tax rates and deferred tax assets. As a result, providing precise estimates for tax provisions becomes challenging.

Structural changes sometimes trigger changes in legal and regulatory requirements, and ensuring compliance becomes more challenging.

Financial consolidation software can make it easier to account for these structural changes in your financial reporting.

The software allows you to streamline the consolidation process for complex business structures such as partial ownership, intercompany eliminations, multiple currencies and alternate reporting roll-ups. This will help you produce more reliable financial statements, ensure you remain compliant and close your books faster.

When it comes to easing the tax provisioning process, investing in dedicated software is a good idea, as it can help reduce your risk of errors and non-compliance, not to mention save your finance team some valuable time.

Tax provisioning software can automate complex tax calculations (as we covered earlier, there’s a multitude of considerations to account for), minimising the risk of human errors during manual data entry and calculations.

It also ensures consistency in applying tax rules across different financial periods. This standardisation helps you maintain uniformity and reduces the chances of errors that come from inconsistent application of tax regulations.

Tax provisioning software lets your finance team automate repetitive and time-consuming tasks associated with tax calculations.

As a result, your team can trust the numbers and spend less time on manual error-checking, enabling them to focus on interpreting and analysing financial data.

"The benefits of tax provisioning software are threefold; everyone starts off using the same data set as a baseline, automation reduces human error and differences can be easily identified and reconciled. This results in more speed and accuracy in the financial close process."

Andrew Chubb, Director, Solutions Consulting at Vena Solutions

The right tax provisioning software should be able to import financial data from your existing accounting systems in real time. This can include data related to income, expenses and other financial transactions.

Using a complete planning software that can also support tax provisioning lets you go a step further by creating different scenarios to model the impact of various business decisions on tax liabilities. For example, you can simulate changes in revenue, expenses, or organisational structure to understand how these factors influence tax outcomes.

Software like Vena provides a centralised platform for accessing tax-related data. It also has access controls and user permissions to ensure your team members have appropriate levels of access based on their roles. This helps to maintain data security and confidentiality.

Tax provisioning software automates complex calculations involved in estimating current and deferred taxes. This saves time and minimises the chance of errors, leading to accurate results just in time for financial close.

Tanger Outlets saw a 50% reduction in its month-end close time using Vena.

Initially, the team spent much of their time on their financial reporting processes, which had workflows of up to 179 actions. They relied on Excel spreadsheets alone and manual data entry, which was tedious and error-prone.

When they moved their financial close process to Vena, Tanger Outlets was able to cut their month-end close from 10 days to just five and their year-end close from three weeks to only two.

Their tax team also automated the separation of non-tax-deductible and tax-deductible items, saving one week per quarter.

Want to achieve results like this for yourself? Learn how Vena can help you reduce errors associated with manual data entry, make accurate tax provision estimates and accelerate the financial close process.

Jessica Tee Orika-Owunna is a content strategist and writer with over seven years of experience creating and repurposing relatable, helpful content for global brands including Contentsquare, Softr, Hotjar and Vena. She specializes in turning everyday product, user, and subject matter expert insights into product-led content that answers real buyer questions and supports better business outcomes.